What is Mobile Payment Processing?

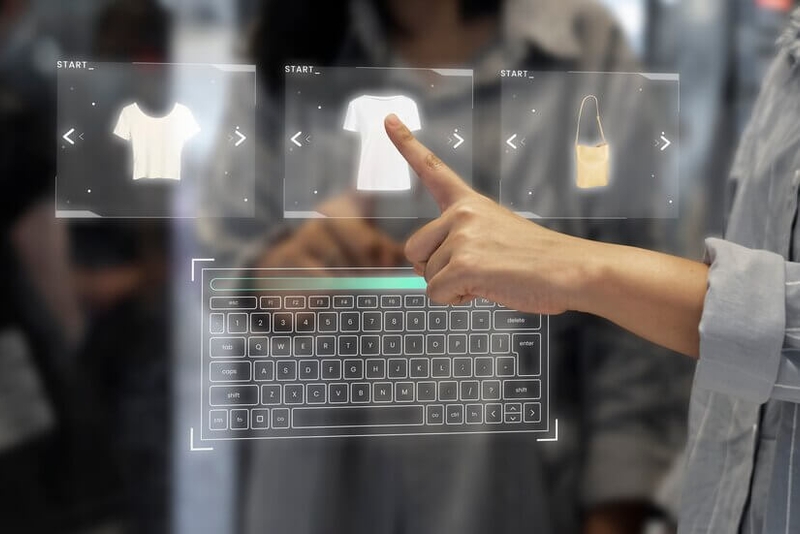

Mobile payment processing lets people make payments using their mobile devices, changing how we handle money and ditching traditional payment methods.

VELLIS NEWS

25 Mar 2025

By Vellis Team

Vellis Team

Automate your expense tracking with our advanced tools. Categorize your expenditures

Related Articles

Vellis News

25 March 2025

Alternative Payment Methods: A Comprehensive Guide

Long forgotten are the days when cash and cards were the only ways to pay for something. Nowadays, an abundance of innovative technological changes has brought upon spring and professional alternative payment methods that are becoming more popular due to their speed, efficiency, and reliance. The shift from traditional (seemingly slow and boring) credit card payments to cutting-edge digital solutions has opened up numerous advantages.

Vellis News

31 March 2025

Understanding the Ecommerce Payment System: A Guide for Online Merchants

In the fast-paced world of online shopping, having a reliable ecommerce payment system is crucial for business success. This system enables merchants to securely accept payments from customers using various methods, including credit cards, digital wallets, and bank transfers. Choosing the right ecommerce payment solutions ensures smooth transactions, enhances customer trust, and boosts sales.

Vellis News

31 March 2025

What Is Credit Migration Risk and How Does It Affect Businesses?

Credit migration risk is crucial to financial stability, particularly for businesses and investors dealing with high-risk industries. It refers to the risk that a borrower’s credit quality may deteriorate, leading to increased borrowing costs, reduced asset value, and potential financial instability. This article explores credit migration risk, its implications across different industries, and strategies to mitigate its impact.

How Mobile Payment Processing Works

The mobile payment process starts when a customer initiates a transaction using their phone or tablet. This can be done by tapping an NFC-enabled reader, scanning a QR code, or using a mobile credit card reader.

Once the payment information is sent, a secure gateway processes the data, checks for fraud, and verifies fund availability with the customer’s bank. After approval, the funds transfer to the merchant’s account. Businesses choosing a mobile payment processing system should consider compatibility, transaction fees, and security compliance to ensure smooth transactions.

Types of Mobile Payment Processing Solutions

Mobile payment processing solutions have evolved to meet diverse customer needs. From tapping a phone to scanning a QR code, these options provide convenience and speed.

Mobile Credit Card Processing

Card readers, NFC technology, and chip-enabled payments allow businesses to accept payments anywhere. Solutions like Square, Helcim, Clover Go, Areto Payment, and PayPal Zettle lead the market. Square, for instance, is popular for its transparent pricing and free magstripe card reader.

Mobile point-of-sale (mPOS) devices function as portable cash registers, enabling remote payments and ensuring security through PCI-compliant gateways.

Digital Wallets and Contactless Payments

Digital wallets store card details on smartphones, allowing fast, touch-free payments via services like Apple Pay and Google Pay. The mobile POS market is expected to hit $1.28 trillion by 2027, with nearly 95 million users opting for contactless transactions.

For businesses, choosing a merchant services provider with NFC reader functionality and PCI compliance is crucial to stay competitive.

QR Code Payments

QR codes make transactions seamless. Customers simply scan a code to pay, eliminating the need for physical cards. This method is part of the growing mobile payment ecosystem, offering a fast, secure alternative for businesses looking to enhance customer experience.

Mobile Payment Apps and Peer-to-Peer (P2P) Transfers

Apps like Venmo and PayPal make peer-to-peer (P2P) transfers easy. Users can split expenses or pay for services instantly without cash. For businesses, mobile wallets improve checkout speed and efficiency, creating a frictionless payment experience.

Benefits of Mobile Payment Processing for Businesses

Mobile payment processing improves business efficiency by simplifying transaction procedures, simultaneously accelerating sales while improving customer contentment through straightforward payments.

Faster Transactions and Increased Sales

With mobile POS systems, transactions are processed in real-time, speeding up checkout and boosting sales. Mobile POS payments are expected to reach 95 million users by 2027, indicating growing consumer preference for quick payments.

Improved Security and Fraud Prevention

Mobile payment processing enhances security with encryption, NFC technology, and multi-factor authentication, reducing fraud risks. Real-time monitoring further protects against threats, ensuring safe transactions.

Cost Savings and Lower Processing Fees

Solutions like Square and Helcim offer cost-effective pricing models. For instance, Square’s 2.6% + $0.15 per swipe fee provides transparency, while Helcim’s interchange-plus pricing benefits businesses with high transaction volumes.

Integration with Business Management Tools

Many mobile payment processors integrate seamlessly with accounting software, CRM systems, and inventory tracking tools. This helps businesses streamline operations and make data-driven decisions.

Challenges and Risks in Mobile Payment Processing

Despite its advantages, mobile payment processing comes with challenges such as security concerns, connectivity issues, and consumer adoption barriers.

Security Concerns and Data Breaches

Data breaches, identity theft, and fraud remain risks. Strong encryption and multi-factor authentication help protect transactions, but businesses must stay vigilant with security updates and real-time monitoring.

Connectivity and Technical Limitations

System outages and poor connectivity can disrupt transactions. Businesses need reliable internet and backup solutions to ensure smooth payment processing.

Consumer Trust and Adoption Barriers

Some consumers hesitate to adopt mobile payments due to security concerns or lack of awareness. Businesses can build trust by offering secure, user-friendly payment options and educating customers on their benefits.

How to Choose the Best Mobile Payment Processing Solution

Selecting the best mobile payment processing solution involves comparing features, security, and costs.

Factors to Consider

Choosing the right mobile payment processing solution requires careful thought about several key factors. Here are some considerations to take note of:

- Transaction Fees – Compare merchant fees to find an affordable option.

- Compatibility – Ensure it integrates with existing POS systems.

- Security Features – Look for PCI compliance and encryption.

- Customer Support – Reliable support is essential for troubleshooting.

- Payment Flexibility – Choose a system that supports various payment methods, including NFC and digital wallets.

Comparing Top Mobile Payment Processing Providers

Square, Helcim, Clover Go, QuickBooks GoPayment, and Vellis offers top-of-the-line payment processing solutions. Square is ideal for small businesses with its transparent pricing, while Helcim benefits high-volume merchants with competitive rates. With the mobile POS market projected to grow to $1.28 trillion by 2027, businesses must choose wisely to stay ahead.

Future Trends in Mobile Payment Processing

Innovations like AI, biometric authentication, and cryptocurrency are shaping the future of mobile payments.

AI and Machine Learning in Mobile Payments

AI enhances fraud detection, streamlines payments, and personalizes user experiences. Machine learning helps identify suspicious transactions, improving security and efficiency.

The Rise of Biometric Authentication

Fingerprint and facial recognition are becoming standard in mobile payments. By 2025, biometric authentication will secure over $3 trillion in transactions, with 81% of users preferring fingerprints over PINs.

Cryptocurrency and Blockchain in Mobile Transactions

Blockchain technology offers secure, transparent, and efficient transactions. As 44% of consumers see cryptocurrency as a viable future payment method, businesses may soon integrate blockchain for faster, low-cost transactions.

The best mobile payment processing solutions offer speed, security, and convenience for both businesses and customers. As mobile transactions continue to grow, businesses that adopt innovative payment methods will stay ahead of the competition. Whether through digital wallets, QR codes, or AI-driven security features, mobile payments are transforming the way we pay.

FAQs – Common Questions About Mobile Payment Processing

What are the best mobile payment processing solutions?

Square, Helcim, Clover Go, QuickBooks GoPayment, and PayPal Zettle.

How secure are mobile payments?

Mobile payments use encryption, tokenization, and multi-factor authentication to enhance security.

What is the cost of mobile payment processing?

Costs vary but typically include transaction fees (e.g., Square charges 2.6% + $0.15 per swipe) and potential monthly fees.

Can small businesses benefit from mobile payment processing?

Yes, it enables fast transactions, lower costs, improved security, and better customer convenience.

References

GoCardless. (n.d.). How do mobile payment systems work? Retrieved March 25, 2025, from GoCardless website:

https://gocardless.com/en-us/guides/posts/how-do-mobile-payment-systems-work/

Worldpay. (n.d.). 5 advantages of mobile payments acceptance. Retrieved March 25, 2025, from Worldpay website:

https://www.worldpay.com/en/insights/articles/5-advantages-of-mobile-payments-acceptance

Fifth Third Bank. (n.d.). Benefits of mobile payments for small business. Retrieved March 25, 2025, from Fifth Third Bank website:

https://www.53.com/content/fifth-third/en/financial-insights/business/treasury-cash-flow/benefits-of-mobile-payments-for-small-business.html

Ready to transform your financial management?

Sign up with Vellis today and unlock the full potential of your finances.

Related Articles

Vellis News

31 March 2025

Global Growth: High-Risk Business Expansion Strategies with Tailored Payment Processing Solutions

Developing a high-risk business on a global scale presents unique hurdles. A critical consideration that could tremendously influence your global expansion strategies is the competency of high-risk payment processors.

Vellis News

27 March 2025

OpenCart vs Oscommerce Comparison; which eCommerce Platform is the Best for You

The modern e-commerce platform market is saturated with a plethora of options. Whether you are a newbie or an experienced e-commerce entrepreneur you have a critical decision to make the software that suits your needs.

Vellis News

25 March 2025

What Are Cross-Border Payments?

Cross-border payments refer to transactions where money moves between two countries. Whether for purchasing goods, sending money to family, or facilitating international business, these payments are essential for global trade and finance. Methods include bank transfers, credit card payments, e-wallets, and mobile payments.

We use cookies to improve your experience and ensure our website functions properly. You can manage your preferences below. For more information, please refer to our Privacy Policy.

© 2025 Vellis Inc.

Vellis Inc. is authorized as a Money Services Business by FINTRAC (Financial Transactions and Reports Analysis Centre of Canada) number M24204235. Vellis Inc. is a company registered in Canada, number 1000610768, headquartered at 30 Eglinton Avenue West, Mississauga, Ontario L5R3E7, Canada.